Fill in a Valid Rhode Island 100 Form

Managing the final affairs of a loved one can be a challenging and emotionally taxing process, particularly when navigating the complexities of estate taxes and regulatory filings. In Rhode Island, the Form 100 plays a crucial role in this process, helping personal representatives fulfill their obligations under the law. This form is required for estates where the deceased held any real estate or securities within the state that necessitate the discharge of an estate tax lien or an estate tax waiver, respectively. It facilitates the smooth transition of assets to beneficiaries by ensuring all Rhode Island estate taxes are accounted for and paid, if necessary. The form serves various purposes depending on whether a federal return is needed, whether Rhode Island estate taxes are due, or if an estate requires a Certificate of No Tax Due. Moreover, it collects detailed information about the decedent’s assets, both within Rhode Island and elsewhere, calculating the estate's worth before deductions to determine the tax implications accurately. Estate representatives must also consider specific sections dedicated to real estate and securities requiring attention. It’s important to note, the information provided within the form, including a detailed schedule for tax computation, is affirmed under the penalties of perjury, underscoring the gravity and legal implications of the document. The Rhode Island 100 form, therefore, is an indispensable tool for ensuring compliance with state tax regulations during the often-difficult period following a loved one’s passing.

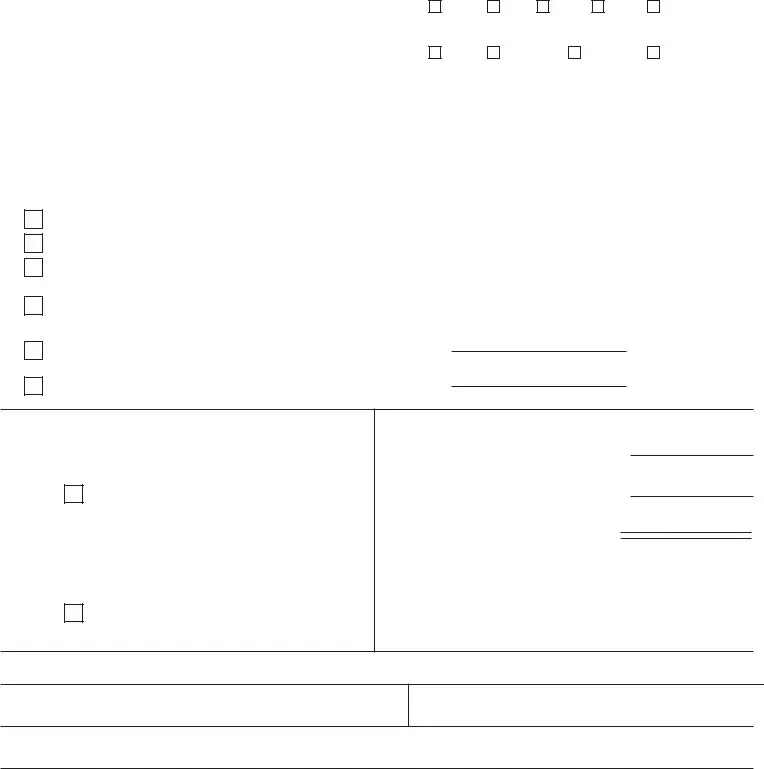

Example - Rhode Island 100 Form

FORM 100 |

STATE OF RHODE ISLAND AND PROVIDENCE PLANTATIONS |

|

|

|

|

|||||||||||||||

D |

IVISION OF AXATION |

- E |

STATE |

|

AX |

S |

ECTION |

FILING FEE $25.00 |

|

|

|

|||||||||

|

|

|

T |

|

|

|

|

|

T |

|

|

|

|

|

||||||

|

E |

|

T |

C |

|

|

|

T |

|

|

|

|

|

|

DEATH CERTIFICATE REQUIRED |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

STATE |

AX |

|

REDIT |

|

RANSMITTAL |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||

Estate of |

|

|

|

|

|

|

|

|

|

|

|

Date of Death |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Address |

|

|

|

|

|

|

|

|

|

|

|

Social Security Number |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

City, State and Zip Code |

|

|

|

|

|

|

|

|

|

|

|

Probate Case Number and Location |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Name of Personal Representative |

|

|

|

|

|

|

|

|

|

|

Relationship - Personal Representative is: |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse |

Child Sibling Parent |

Other |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

Capacity: |

|

|

Person in |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Executor |

Administrator |

Possession |

Other |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

of Property |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, State and Zip Code |

|

|

|

|

|

|

|

|

|

|

|

Telephone |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name of Attorney |

|

|

|

|

|

|

|

|

|

|

|

Telephone |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Address |

|

|

|

|

|

|

|

|

|

|

|

City, State and Zip Code |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A Federal return is not required to be filed, but a Certificate of No Tax Due is requested.

A Federal return is attached, but no Rhode Island tax is due. A Certificate of No Tax Due is required.

A Federal return is attached. A Notice of Estate Taxes Assessed is requested.

Payment of Rhode Island estate taxes is enclosed in the amount of $________________.

The Federal return is attached showing computation of the total credit. Apportionment is as shown in section II below.

An extension of time to file the Federal return has been approved. Extension Date: (A true copy attached.)

An extension of time to pay the Federal Tax has been approved. Extension Date: (A true copy attached.)

SECTION I:

REAL ESTATE REQUIRING DISCHARGE OF LIEN

Did the decedent have any interest in real estate located in Rhode Island requiring a discharge of estate tax lien?

Yes |

|

No |

|

|

|

Please include a typed Form

SECURITY REQUIRING ESTATE TAX WAIVER

Did the decedent have any interest in a security of a Rhode Island incorporated business requiring an estate tax waiver?

Yes |

|

No |

|

|

|

Please include a typed Form

SECTION II:

RHODE ISLAND ASSETS: $

TOTAL: $

If a Federal Estate tax return is required, enter the total gross value for Federal Estate and Generation Skipping Tax purposes.

If no Federal Estate tax return is required, enter the total gross value of the decedent's estate. Gross value means the total value of the assets before any deductions.

Under penalties of perjury, I declare that I have examined this return including accompanying schedules and to the best of my knowledge and belief,

it is true correct and complete

Signature of personal representative |

Date |

Signature of preparer |

Date |

Name, address and telephone number of preparer (please print or type)

Phone #

Revised 08/07/2008

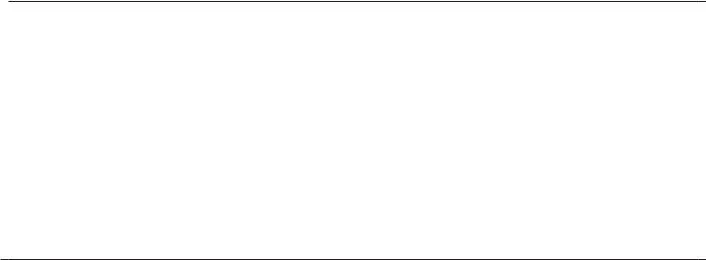

SCHEDULE A: COMPUTATION OF TAX - DECEDENT DOMICILED IN RHODE ISLAND

1. |

Federal Credit for State Death Taxes from Federal Form 706: |

|

|

$ |

|

||||||||||

2. |

Death |

taxes paid to a |

state |

other than |

Rhode |

Island: |

|

$ |

|

|

|

||||

|

|

(If none, skip lines 2 through 7. Enter amount from line 1 on line 8). |

|

|

|

|

|

||||||||

3. |

Federal Gross Estate from Federal Form 706: |

|

|

|

|

$ |

|

|

|

||||||

4. |

|

|

|

|

|

|

$ |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|||||||

5. |

Percentage of |

% |

|||||||||||||

|

|

(Divide Line 4 by Line 3). |

|

|

|

|

|

|

|

|

|

|

|

||

6. |

Adjusted State Death Tax Credit - Multiply Line 1 by Line 5: |

|

|

|

$ |

|

|

|

|||||||

7. |

Enter the lesser of line 2 or line 6: |

|

|

|

|

|

|

$ |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||||

8. |

Tax Payable to Rhode Island (Line 1 less line 7): |

|

|

|

|

$ |

|

||||||||

|

|

|

B: C |

|

T |

- D |

D |

|

O |

|

R |

||||

S |

|

OMPUTATION OF |

|

UTSIDE OF |

|||||||||||

|

CHEDULE |

|

AX |

|

ECEDENT OMICILED |

|

|

HODE ISLAND |

|||||||

1. |

Federal Credit for State Death Taxes from Federal Form 706: |

|

|

$ |

|

|

|

||||||||

2. |

Federal Gross Estate from Federal Form 706: |

|

|

|

|

$ |

|

|

|

||||||

3. |

Rhode Island Gross Estate**: |

|

|

|

|

|

|

|

$ |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||||||

4. |

Percentage of Rhode Island Gross Estate to Federal Gross Estate: |

|

% |

||||||||||||

|

|

(Divide Line 3 by Line 2). |

|

|

|

|

|

|

|

|

|

|

|

||

5. |

Tax Payable to Rhode Island (Multiply Line 1 by line 4): |

|

|

|

$ |

|

|||||||||

*

**Rhode Island Gross Estate for a decedent domiciled outside of Rhode Island means the value of real estate and tangible personal property (cars, boats, clothes, jewelry, furniture, etc.) which is located in Rhode Island at the date of death.

PLEASE NOTE: Bank accounts, stocks, bonds and mortgages are intangible assets and are taxable by the state in which the decedent was domiciled at the time of death regardless of where the asset was then located.

Make checks payable to the RI Division of Taxation.

Mail forms and checks to the Rhode Island Division of Taxation Estate Tax Section

One Capitol Hill Providence, RI 02908

Revised 08/07/2008

Document Specs

| Fact Name | Description |

|---|---|

| Filing Fee | The Rhode Island Form 100 requires a filing fee of $25.00. |

| Death Certificate Requirement | A death certificate is required to be submitted along with the Form 100 to the Estate Tax Section of the Rhode Island Division of Taxation. |

| Types of Transmittal | The form allows for various transmittal types including requesting a Certificate of No Tax Due, attaching a Federal return with no Rhode Island tax due, and including a payment of Rhode Island estate taxes. |

| Estate Tax Lien | For real estate in Rhode Island requiring a discharge of estate tax lien, Form T-77 must be included in triplicate for each property. |

| Estate Tax Waiver for Securities | If the decedent had an interest in securities from a Rhode Island incorporated business requiring an estate tax waiver, Form T-79 must be submitted in duplicate for each security. |

Steps to Writing Rhode Island 100

When it comes to handling the affairs of a loved one who has passed, one of the tasks you may find yourself responsible for is dealing with estate taxes. In Rhode Island, the Form 100 is a crucial document for this process, particularly when real estate or financial assets are involved. This form helps in determining the estate's tax obligations to the state and aids in obtaining necessary tax waivers. Filling out this document accurately ensures that the estate is properly managed and that any due taxes are correctly assessed and paid. Below are the steps to guide you through the completion of the Rhode Island 100 form.

- Start by recording the basic information about the deceased, including their full name (listed as "Estate of") and the date of death.

- Enter the deceased's Social Security Number, along with their last known address, including city, state, and zip code.

- Provide the probate case number and location, which you can obtain from the probate court that is handling the estate.

- List the name of the personal representative (executor or administrator) of the estate, their relationship to the deceased, and check the appropriate capacity under which they are serving (e.g., Executor, Administrator).

- Fill in the contact information for the personal representative, including their address and telephone number.

- If there is an attorney involved in managing the estate, record their name, telephone number, and address as well.

- Select the appropriate box that best describes the filing condition of the estate: whether a federal return is not required, a federal return is attached with no Rhode Island tax due, a Certificate of No Tax Due is required, etc.

- Answer the questions in Section I regarding any interest in real estate located in Rhode Island and requiring a discharge of estate tax lien and any Rhode Island incorporated business securities requiring an estate tax waiver. If "Yes," ensure to include the respective forms (T-77 for real estate, T-79 for securities) as instructed.

- In Section II, thoroughly compute the Rhode Island assets, non-Rhode Island assets, and provide totals, along with clarifying whether a Federal Estate Tax return is required.

- Sign and date the form at the bottom as the personal representative. If someone else prepared the form on your behalf, their signature, name, address, and telephone number should also be included.

- Enclose the filing fee of $25.00, and if applicable, include any payment for Rhode Island estate taxes.

- Mail the completed form along with any attachments and the appropriate fee/payment to the Rhode Island Division of Taxation Estate Tax Section at the address provided.

Key Facts about Rhode Island 100

What is the Rhode Island 100 form?

The Rhode Island 100 form is a document used by the State of Rhode Island and Providence Plantations Division of Taxation - Estate Tax Section. It's used for reporting and paying estate taxes due for a deceased person's estate. This form is required to ensure that any interest in real estate or securities within Rhode Island are properly handled and that appropriate taxes are paid or waived.

When is the filing fee for the Rhode Island 100 form, and how much is it?

The filing fee for the Rhode Island 100 form is $25.00. This fee must be submitted along with the completed form to the Rhode Island Division of Taxation.

Is a death certificate required for the Rhode Island 100 form?

Yes, a death certificate is required when filing the Rhode Island 100 form. The submission ensures that the estate tax process is validated with official documentation of the decedent's death.

What information is needed to fill out the Rhode Island 100 form?

To correctly fill out the Rhode Island 100 form, you'll need several pieces of information, including the decedent's date of death, their address, social security number, probate case number and location, details about the personal representative, and information regarding the estate's attorney. Additionally, details about real estate and securities in Rhode Island, as well as a detailed list of Rhode Island and non-Rhode Island assets, are needed.

What should I do if the estate requires a Certificate of No Tax Due?

If the estate requires a Certificate of No Tax Due, you should indicate this on the Rhode Island 100 form. You have several options based on whether a federal return is filed and whether Rhode Island tax is due. Select the appropriate option to ensure that the estate is processed correctly, and the necessary certificate is issued.

How do I handle interests in real estate or securities on the Rhode Island 100 form?

If the decedent had interest in real estate or securities from a Rhode Island incorporated business, you must indicate this on the form. For real estate, include a typed Form T-77 in triplicate for each property. For securities requiring an estate tax waiver, include Form T-79 in duplicate for each security.

What if an extension of time to file or pay the federal tax has been granted?

If an extension of time to file or pay the federal tax has been granted, you should mark the appropriate section on the Rhode Island 100 form and attach a true copy of the approval. Ensure to provide the extension date for accurate processing.

How do I calculate the tax payable to Rhode Island?

To calculate the tax payable to Rhode Island, you'll need to reference the Federal Credit for State Death Taxes from Federal Form 706, and then adjust based on whether the decedent was domiciled in or outside of Rhode Island. The form guides you through calculating the adjusted state death tax credit and subtracting death taxes paid to other states, if applicable.

Where do I mail the completed Rhode Island 100 form and payment?

Once you've completed the Rhode Island 100 form and attached the necessary documents and payment, mail everything to the Rhode Island Division of Taxation Estate Tax Section, One Capitol Hill, Providence, RI 02908. Make sure checks are payable to the RI Division of Taxation.

Common mistakes

Filling out the Rhode Island Form 100, a crucial step in managing estate matters, can be quite complex. Unfortunately, it's easy to make mistakes that can delay processing times or even lead to incorrect tax calculations. Here are some common errors to avoid:

- Omitting the death certificate. The Rhode Island Division of Taxation requires a death certificate to be attached to the Form 100. Leaving this out can result in immediate rejection of the form.

- Incorrect or incomplete estate asset values. This form demands precise information about both Rhode Island assets and non-Rhode Island assets. Underestimating or failing to report these values accurately can lead to wrongful tax assessments.

- Not including necessary supplementary forms. Depending on the decedent’s assets, you might need to attach Form T-77 for real estate and Form T-79 for certain securities. Forgetting these forms can stall the discharge of estate tax liens or waivers.

- Failing to request the correct tax document. The form offers options such as requesting a Certificate of No Tax Due, a Notice of Estate Taxes Assessed, or submitting payment with the form. Selecting the incorrect option can affect the estate’s tax obligations.

- Leaving the preparer's information blank. Even if the personal representative completes the form, the information about who prepared it is essential. This includes any third-party help such as a legal advisor or an accountant.

- Misunderstanding the extension dates. If an extension of time to file the Federal return or pay the Federal Tax has been granted, it must be correctly noted, and copies of the approval must be attached. Confusion or inaccuracy here can lead to penalties or fines.

- Review each section thoroughly before submission.

- Verify all numbers, specifically those related to the estate's value and tax calculations.

- Regularly consult with a professional if there’s any confusion. This could be a tax advisor or attorney familiar with Rhode Island’s estate tax laws.

- Keep a copy of the completed form and all attachments for your records.

It’s important to approach filling out the Form 100 with attention to detail and complete information. Mistakes can not only delay the process but may also affect the estate financially. Double-checking all filled sections against supporting documents can help avoid these common pitfalls.

To ensure the Form 100 is filled out correctly:

By avoiding these common errors, personal representatives can ensure they meet their obligations while minimizing the potential for delayed processing or unexpected impacts on the estate's financial responsibilities.

Documents used along the form

When handling the aftermath of a loved one's passing, it's important to know that the Rhode Island 100 form is just one part of the process. This form is essential for managing the estate, but there are other documents that often play critical roles as well. Understanding these documents can help ease the burden during such a difficult time, ensuring that all legal and financial aspects are appropriately managed. Here's a look at eight other documents that are commonly used in conjunction with the Rhode Island 100 form:

- Death Certificate: This official document confirms the death of an individual. It is required for many legal processes, including the filing of the Rhode Island 100 form and accessing bank accounts or insurance policies.

- Will: A legal document outlining the deceased's wishes regarding how their estate should be distributed. It often names an executor responsible for carrying out these wishes.

- Trust Documents: If the deceased had a trust set up, these documents will outline the distribution of assets within the trust and detail the trustees’ responsibilities.

- Probate Court Documents: Various documents filed with the probate court, including the petition for probate, which starts the process of legitimizing a will and administering the estate.

- Form T-77 (Real Estate Tax Clearance): Required for any real estate in Rhode Island that needs a discharge of estate tax lien, as mentioned in the Rhode Island 100 form instructions.

- Form T-79 (Securities Tax Waiver): Needed for securities held in any Rhode Island incorporated business requiring an estate tax waiver.

- Letter of Testamentary or Letter of Administration: Issued by the probate court, giving the executor or administrator the authority to act on behalf of the deceased’s estate.

- Form 706 (Federal Estate Tax Return): While not always required, this federal form may be necessary if the estate exceeds certain thresholds, detailing the estate's valuation for federal tax purposes.

Navigating the estate administration process can be overwhelming, especially during a time of grief. These documents, when used alongside the Rhode Island 100 form, provide a pathway through the legal and financial steps necessary to settle an estate. Handling these documents with care and attention ensures that the process respects the deceased's wishes and complies with state and federal laws. Remember, it's always beneficial to seek guidance from legal professionals who can provide support and clarity on managing these important documents.

Similar forms

The Rhode Island 100 form is similar to several other estate-related documents in various jurisdictions, primarily in how it addresses estate taxes, asset declarations, and the involvement of personal representatives. Each of these documents serves a primary function of detailing an estate's assets and liabilities, providing a crucial role in the estate planning and probate process.

Form 706 (United States Estate (and Generation-Skipping Transfer) Tax Return): Just like the Rhode Island 100 form, the Form 706 is required for reporting the estate's gross value for federal estate and generation-skipping transfer tax purposes. Both forms require detailed information regarding the deceased's assets, deductions, and applicable tax computations. However, Form 706 is used for federal tax purposes, while the Rhode Island 100 form is specifically for the state's estate tax considerations, including instances where a federal return may not be required but a state declaration is necessary.

Form T-77 (Real Estate Lien Discharge Request): Included within the Rhode Island 100 filing process, Form T-77 is necessary when the decedent had an interest in real estate requiring the discharge of an estate tax lien in Rhode Island. This form bears similarity to the real estate section of the Rhode Island 100 form by focusing on real estate assets; however, Form T-77 specifically deals with the clearance of tax liens, illustrating a more targeted approach within the broader estate tax reporting process.

Form T-79 (Estate Tax Waiver Request for Securities): Coupled with the Rhode Island 100 form, Form T-79 is used for securities held by the deceased that were part of a Rhode Island incorporated business. This form's purpose is analogous to the securities section of the Rhode Island 100 form but is specifically designed to request an estate tax waiver for such securities. This delineates the distinction between a general estate asset declaration and the particular treatment of local securities subject to estate tax waivers.

Dos and Don'ts

When completing the Rhode Island Form 100 for estate tax purposes, it's important to approach the process with care and attention to detail. Here are several key dos and don'ts to keep in mind:

- Do ensure that all information provided is accurate and complete. Errors or omissions can lead to delays in processing or additional scrutiny from the Rhode Island Division of Taxation.

- Do attach a death certificate if required. This vital piece of documentation is necessary for processing the Form 100.

- Do include a typed Form T-77 in triplicate for each Rhode Island property requiring a discharge of estate tax lien, if applicable.

- Do include a typed Form T-79 in duplicate for each Rhode Island incorporated business security requiring an estate tax waiver, if applicable.

- Do double-check the computation of the tax, especially if the estate includes assets both inside and outside of Rhode Island. Accurate calculations are crucial for the correct tax payment.

- Do pay the $25.00 filing fee. This is required for the submission of Form 100.

- Do keep a copy of the Form 100 and all attachments for your records. Having a comprehensive record can be helpful in case of any questions or audits.

Conversely, here are things you should avoid:

- Don't leave sections incomplete. If a section does not apply, indicate this with “N/A” (not applicable) rather than leaving it blank.

- Don't forget to sign and date the form. An unsigned form is considered invalid and will not be processed.

- Don't disregard the requirement for additional forms (T-77 and T-79) if they pertain to the decedent’s assets.

- Don't estimate values of assets. Use exact figures whenever possible to ensure the accurate calculation of taxes.

- Don't fail to check whether a Federal estate tax return is necessary. This determination can impact the documentation needed for the Rhode Island estate tax filing.

- Don't miss the filing deadline. Timely submission is essential to avoid late fees and penalties.

- Don't hesitate to seek professional advice if you're unsure about any part of the process. Consulting with a tax professional or attorney can help avoid costly mistakes.

Misconceptions

When dealing with the Rhode Island Form 100, there are several misconceptions that commonly arise. Understanding and clarifying these myths can help in the accurate completion of the estate tax filing process.

- Misconception 1: The filing fee is negotiable or can be waived. The filing fee for Form 100 is set at $25.00 and is not subject to negotiation or waiver.

- Misconception 2: A death certificate is optional when filing. In reality, a death certificate is a mandatory document that must be included with the Form 100 submission.

- Misconception 3: Only Rhode Island residents need to file Form 100. This form is required for any estate that includes assets located in Rhode Island, regardless of the decedent's residency.

- Misconception 4: All types of assets must be listed on Form 100. Although it is crucial to report assets, it's important to note that bank accounts, stocks, bonds, and mortgages are considered intangible assets and are taxed based on the decedent’s domicile rather than their location at the time of death.

- Misconception 5: A federal estate tax return is always required to be filed with Form 100. The instructions clearly outline scenarios in which a federal return is not necessary but request that a Certificate of No Tax Due is included.

- Misconception 6: The calculation of taxes is straightforward and does not require detail. In actuality, the computation of tax involves detailed schedules that differentiate between decedents domiciled in Rhode Island and those domiciled outside the state, as well as considerations for federal credits and taxes paid to other states.

- Misconception 7: Extensions for filing or paying federal taxes do not affect Form 100. If an extension has been granted for filing or paying federal taxes, evidence of this extension must be attached to Form 100.

- Misconception 8: A personal representative can sign the form without verifying its accuracy. On the contrary, by signing Form 100, the personal representative declares under penalty of perjury that the information provided is true, correct, and complete to the best of their knowledge.

- Misconception 9: Once Form 100 is filed, no further documentation is necessary for the discharge of estate tax liens on real estate. In fact, for any real estate located in Rhode Island requiring a discharge of lien, a typed Form T-77 must be submitted in triplicate for each property.

Clarifying these misconceptions is vital for the accurate and efficient handling of estate tax matters in Rhode Island. By understanding the precise requirements and procedures, personal representatives can ensure compliance and minimize complications during the estate settlement process.

Key takeaways

When preparing and submitting the Rhode Island 100 form for estate tax purposes, it's crucial to understand the documents and details required to ensure a smooth process. Here are four key takeaways to guide individuals through this procedure:

- A filing fee of $25.00 is necessary for the Rhode Island 100 form. This fee accompanies the form submission to the Division of Taxation - Estate Tax Section.

- The submission of a death certificate is mandatory. Including the death certificate verifies the decedent's date of death, a crucial piece of information for estate tax considerations.

- Depending on the assets and the decedent’s domicile, different sections of the form apply. For instance, assets located in Rhode Island may require additional documentation, such as Form T-77 for real estate or Form T-79 for securities from Rhode Island incorporated businesses.

- Accurate asset valuation is key. For assets within Rhode Island and elsewhere, the form requires a detailed account of their gross value. This valuation must reflect the total worth before deductions, influencing the estate's tax obligations.

By paying attention to these key aspects, individuals can accurately fulfill their duties, reducing the potential for errors or delays in the estate tax process. Always ensure that all sections relevant to the decedent's estate are completed fully and accurately.

Consider Common PDFs

Forma W9 Para Imprimir 2023 - Individuals and entities are encouraged to update their Rhode Island W-9 information as needed.

Rhode Island Asbestos Legal Question - The Rhode Island ASB-22 form is essential for notifying the Department of Health about upcoming asbestos abatement projects.